HRD Deep Dive: Brexit and business - The story so far

- 7 Min Read

With the disruption caused by COVID-19, public attention has been diverted from Brexit for the majority of 2020. However, with a matter of weeks remaining until the transition period ends, the time is now for organizations to prepare for the changes. In this week’s HRD Deep Dive, we took a closer look.

- Author: Sam Alberti

- Date published: Oct 5, 2020

- Categories

30-second summary:

- Less than four months remain until the end of the UK’s transition period following its departure from the EU

- At present, a ‘no-deal’ scenario looms

- Supply chains and the labor market are likely to be adversely affected

- Organizations must recognize this and prepare accordingly

On July 28th 2016, the Great British public voted to leave the European Union after more than 40 years of alliance. In the eyes of many, this presented one of the greatest spectres the business world has faced for generations.

However, in truly ironic fashion, 2020 has brought a socioeconomic and corporate crisis of even greater proportions. As a result, the world’s attention has been diverted, and Brexit’s ominous shadow appears to have receded.

That said, this is set to change immanently. Though COVID-19 rages on, negotiations between Great Britain and the EU are reaching a critical a stage, with crucial trade talks due take place in the coming weeks – less than four months before the Brexit transition period ends.

As it stands, both sides are hoping to reach a conclusive agreement prior to the European Council meetings on October 15th and 16th, which will allow talks to progress into the so-called ‘tunnel’ phase: the final stage of negotiations, during which the legal text will be agreed upon and confirmed.

Business leaders will now be keeping one eye on the scenario and beginning to assess how the outcome of the talks could impact their organizations.

The story so far

The UK officially left the European Union on 31 January 2020, as per the withdrawal agreement. However, changes would not take effect for nearly another year. This became know as the ‘transition’ period.

During this period, talks have taken place to negotiate area such as trade, fishing access, the regulation of medicine, and security operations.

However, as yet, the period has not been as fruitful as many had hoped, with COVID-19 proving a significant barrier. What’s more, the deadline for extending the transition has now passed, which means the two sides edge ever close to a no-deal scenario.

But what would this entail? Well, most notably, failure to reach a deal would result in tariffs and border checks being applies to UK exports to the EU, and vice versa.

Secondly, the UK service industry could also face adverse effects, losing guaranteed access to the EU markets. This could impact anyone from bankers, to chefs, to lawyers.

What’s more, any trade deals between the UK and non-EU nations will be allowed to commence from February 1st 2021. Eurosceptics argue that the UK being able to dictate its own trade policy will be beneficial for the economy – this is debatable.

Virtually for certain, however, is the fact that many UK and EU businesses will have to prepare for these changes accordingly.

Impact on supply chains

It is thought that supply chains will be one of the most critically hit aspects of business as a result of the Brexit saga. This is primarily because, as it stands, the UK’s trading relationship with the EU is founded on free movement of services, capital, goods and labour. Based on this, it has proven a relatively simple task to manage a supply chain between the two, with minimal cost and logistics involved.

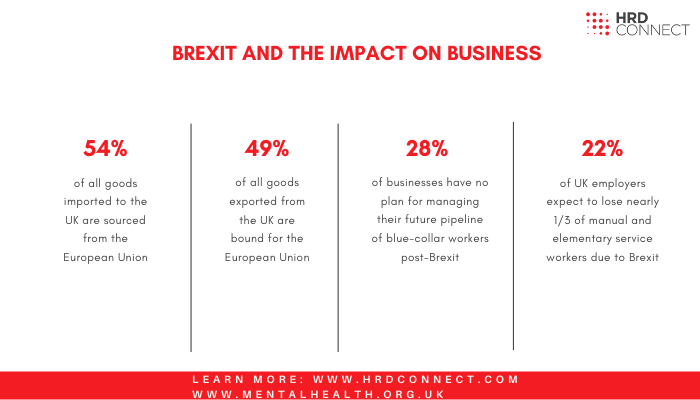

However, with each passing day, it becomes increasingly likely that on February 1st 2021, customs will be introduced between the UK and the EU. This could bring about untold damage to UK business, with studies estimating that the EU accounts for 54% of all goods imported to the UK, and 49% of goods exported. With tariffs applied to these transactions, the financial impact could be one of significant proportions.

Based on this, organizations will have to rethink supply chain strategy in order to maximize profitability. For instance, many UK businesses reacted quickly by stockpiling key products. According to The Guardian, major organizations such as Jaguar Land Rover and Siemens UK began increasing their inventory of key components in 2019.

Research by McKinsey has found that adjusting stock levels accordingly can have a significant impact. The study, which comprised information obtained from 50 UK firms, found that: revenue increased by more than 3% by minimizing stock-outs; write-downs decreased by up to 45% by minimizing excess unwanted products; and capital expenditure dropped by at least 5% by eliminating the need for capacity expansion at plants to produce excess safety stock.

Besides adjusting stock, it is recommended that organizations take on initiatives such as preparing to absorb additional costs, and using new data systems in order to more effectively manage imports and exports.

Though a mere snapshot, and something that will vary greatly from company to company, this gives some perspective on the importance of adjusting supply chain strategy in order to offset the adverse affects of Brexit. Though some of the steps taking to combat the impact of COVID-19 will stand many organizations in better stead, there is still work to be done to ensure that Brexit does not cause a major blow.

Impact on talent

As is often the case with a major shift in the business climate, talent is set to be one of the other main pressure points as a result of Brexit.

Just as supply chain hinges on the UK’s trade deal with the EU, talent hinges on migration policy. In this regard, the UK government’s newly-formed system will have a major influence on the situation.

The plan was unveiled in February earlier this year, with the Conservative party fulfilling its manifesto promise to introduce a “points-based” immigration system. In short, the plan purports to award equal opportunity to all non-UK citizens by distinguishing between “skilled” and “low-skilled” workers.

Under the plan, points will be awarded for credentials such as receiving a job offer, having a job at an “appropriate” skill level, speaking English, and having a “relevant” PhD in a STEM subject. In order to qualify for a visa, individuals will be required to accumulate 70 points.

The government has described the plan as a “firm and fair system that will attract the high-skilled workers we need to contribute to our economy, our communities and our public services”.

However, there are fears that this will spark reverberations that are significantly disruptive to employers. For instance, it is anticipated that blue-collar, hourly workers will be restricted. Research has found that employers in the UK expect to lose an average of 18% of their manual and elementary service workers as a result of Brexit, with 22% saying they expect to lose 31% or more.

On top of this, the pound’s decline in value, coupled with UK wages not rising much, also has also rendered the prospect of working in the UK less appealing.

Despite this, it is estimated 28% of businesses have no plan for managing their future pipeline of these workers post-Brexit.

In order to safeguard the longevity of the business, organizations must plan for these changes accordingly. Most importantly, this will involve linking talent to value, and deciphering which critical roles are likely to drive the most value in the future. McKinsey estimates that 25-50 of these roles are distributed throughout a typical organization, and notes that “they are not necessarily the most senior roles in the hierarchy”.

Typically, the answer to this would be to conduct a strategic talent review, thoroughly analyzing each role and defining what constitutes success in that particular position.

Furthermore, it is crucial that businesses rethink their approach to talent acquisition and retention as the talent pool changes with the times. Generally speaking, this will involve analyzing the broader needs of the organization and the profile of the workforce, and tweaking the parameters accordingly.