What does our financial future hold?

- 5 Min Read

Our lives are evolving at a rapid rate. We are living in a world of transparency, swift and unpredictable change, and technology that enables us to be globally accessible. Coupled with all these positive shifts, we are also living in a time of excessive debt and financial anguish – not least among our employees.

- Author: Emily Sexton-Brown

- Date published: Feb 21, 2019

- Categories

Debt is not a new issue; it is a problem that each generation faces with their own unique set of challenges and pressures surrounding their financial expectations.

Debt is not a new issue; it is a problem that each generation faces with their own unique set of challenges and pressures surrounding their financial expectations.

Often, employees have an unrealistic view of how best to plan for tomorrow while faced with the reality of managing day-to-day financial challenges. As a leader, are you supporting these employees, and do you value financial wellbeing as a corporate responsibility?

Generational preferences

We now have four generations of employees working side-by-side on a global scale, but not all have the same financial priorities or interests. Currently in the US, 75.4 million people make up the Millennial generation – the largest of generations, who also have the largest debt of any American generation, at around $1.1 trillion. In Aon’s recent report, ‘Living the Dream?’, it was these employees in their early career in the UK who found dealing with money the most stressful and overwhelming. Reward schemes that focus solely on pensions may not benefit this large demographic.

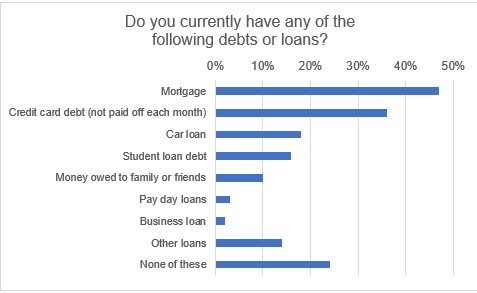

In the same report it emerged that only half of the recipients said that they have a monthly budget, which leads to questions around how the remaining respondents are managing their personal finances. Credit card debt is one of the biggest financial wellness issues faced by many today, with the Bank of England reporting a 10% increase in credit card debt in January 2018. Aon’s research found that one third of respondents have unpaid credit card debt every month, which is inevitably increasing the debt over time and adding unrelenting pressure to the individual. Even if someone clears one outstanding debt, there is a possibility that it has been moved to a different credit card, creating a vicious cycle.

Source: Living the Dream – Aon’s 2018 DC Pension and Financial Wellbeing research

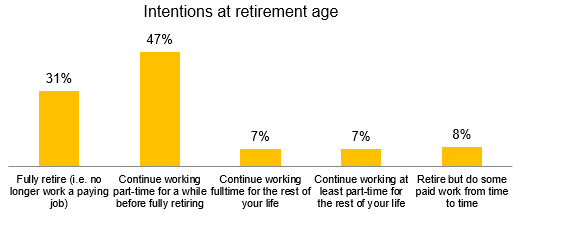

In Aon’s report, 14% of the over 1000 full-time UK employees surveyed stated that they expect to work forever, without a chance of retiring. The view of retirement is changing, with only 31% of employees now expecting to retire fully at retirement age and the majority of respondents expecting to continue some sort of part-time work past retirement age.

It is important for employers to support their employees in areas they need help, whether that is regarding unpaid debts, helping to plan or managing expectations of what retirement will look like.

Source: Living the Dream – Aon’s 2018 DC Pension and Financial Wellbeing research

A corporate responsibility

Are we educating workforces about their future? It is clear that there is a long way to go in this area – and it is becoming a real and tangible issue.

Positively, many people are looking ahead and considering their futures. According to the same report, most are part of the company pension scheme, for example. However, when thinking about how much to save, around two-thirds rely on their employer to set this level. If employees do not engage with planning their future, they will not be able to retire when they want to, and this will have a knock-on effect for employers in areas such as workforce planning.

There is also an obvious need for employers to step up and support the financial wellbeing needs of their workforces. According to Neyber’s 2016 report: The DNA of Financial Wellbeing, employee financial stress costs UK employers £121bn, for example through absenteeism, where time is taken off work due to financial stress and presenteeism, where employees are at work, but their productivity is impacted due to financial worries.

The future of our own financial wellbeing

There are a lot of considerations when planning our own future financial wellbeing, and indeed managing that of others. It’s becoming more and more evident that it is a social and corporate responsibility of any organisation to be invested in their employees’ pension plans. Maybe more importantly, they are also responsible for educating employees fully on setting – and monitoring progress towards – d personal targets to support their financial wellbeing now and in the future.

As our society becomes ever-more driven by and reliant on technology, interactions can become increasingly impersonal and process-driven, which can also contribute to financial stress. Interestingly, Aon found that the most popular method of communication among survey respondents was to be spoken to face-to-face about their financial wellbeing, and that as many as four out of five in their early career would like to receive support from their employer.

Aon’s Global Financial Wellbeing Survey published earlier this year reported that 70% of the global HQs responding felt employers should provide at least an educational role in financial wellbeing, and 50% expected to increase their focus on this in the next 12 months. Employees are increasingly looking to their employer for support in improving their health and wellbeing and in becoming more financially secure. The support given to these employees therefore needs to be clear and reliable, with resources that can help them plan for their financial future.

You can request a copy of the findings from Aon’s 2018 DC Pension and Financial Wellbeing Survey here.