Why building a solid corporate culture should be a HR priority

- 5 Min Read

The understanding and appreciation of corporate culture in the long term success of businesses may never have been higher than at present. Owain Thomas considers the best for HR leaders to develop this culture.

- Author: Owain Thomas

- Date published: Jul 18, 2016

- Categories

The understanding and appreciation of corporate culture and its importance in ensuring organisations are not only profitable but sustainable in the long term may never have been higher than at present.

Owain Thomas considers the best way for HR leaders to embed a healthy workplace culture.

The value of organisational culture is one of the biggest lessons to have been learnt in the corporate world over the last decade, with VW, Tesco and the banking sector all obvious examples of where culture has turned sour and a severe price has been paid.

On some occasions this lesson has been thrust upon an organisation or a sector – whether through market regulation or shareholder action.

But there is also evidence that industries and individual companies are alert to its importance and the platform that a strong, healthy culture can bring.

Of course the starting place for corporate culture is the boardroom and this has been emphasised by the Financial Reporting Council’s (FRC) study, exploring the relationship between corporate culture and long-term business success.

The report explores the importance of culture to long-term value and how corporate cultures are being defined, embedded and monitored.

It makes seven key recommendations that business leaders should practise to install a sound cultural base and recognises that stakeholders and society in general have a vested interest in healthy corporate values, attitudes and behaviours that lead to sustainable growth and long term economic success.

Act now

For business leaders, the most important point it raises is that corporate culture should not wait for a crisis to occur – it should be a priority when times are good that will bring resilience in tougher situations.

FRC chairman Sir Winfried Bischoff noted that a healthy corporate culture led to long-term success by both protecting and generating value in the economy.

“It is therefore important to have a consistent and constant focus on culture, rather than wait for a crisis. A strong culture will endure in times of stress and change,” he said.

“Through our research, it has become clear that establishing the company’s overall purpose is crucial in supporting and embedding the correct values, attitudes and behaviours.”

Encouragingly, the sentiment of the FRC’s guidance may already be being utilised by one of the chief targets – the financial services industry.

Following the financial crash of 2008 the financial services industry suffered a massive fall in public confidence.

One of the main reasons was the fallout from the crash and the glut of stories about market failings and irresponsible risk taking that many people felt was a consequence of a corporate culture that had become rotten to the core.

The seven keys to installing a fit for purpose corporate culture

Flipping the dynamic

Now, however, the industry has flipped this dynamic.

Global financial services firms are choosing to focus on corporate culture and senior leadership instead of financial incentives to prevent excessive risk taking.

Performance management has also become an important factor in ensuring employees do not overstep the mark.

Firms also revealed that they were exploring new approaches with their employee value proposition (EVP), focusing on career development and working practices.

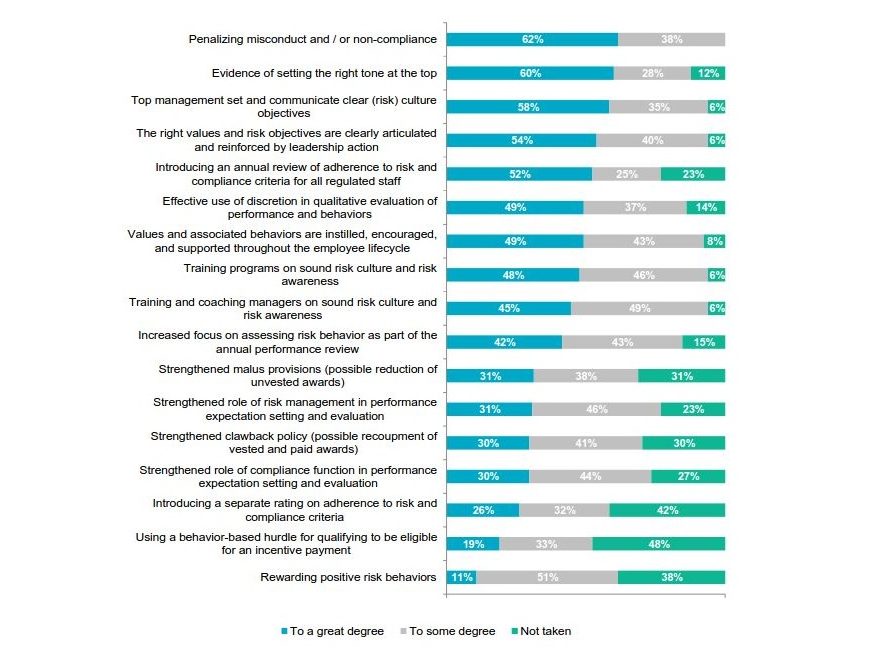

According to Mercer’s Global financial services executive compensation snapshot survey, penalizing misconduct has been the most popular individual method of managing excessive risk taking.

However, it is clear from the results that culture and leadership interventions form the main thrust of how firms are seeking to manage risk.

“It’s encouraging to see companies engaging senior leaders to set an example when it comes to risk taking and compliance behaviours,” said Mercer senior partner and financial services talent leader Vicki Elliott.

“The best way to foster a sound risk culture and combat excessive risk taking is with strong, authentic leadership who are willing to manage consequences for good and bad behaviour.”

Of the 68 companies in 20 countries surveyed, 62% had carried out initiatives to penalise misconduct and non-compliance to a great degree, 60% could show evidence of setting the right tone at the top and 58% were communicating clear risk culture objectives, the report found (see chart below).

At the other extreme, using financial incentives to reward positive risk behaviour was the least likely method to be used – just one in ten firms doing so.

“Proactively rewarding positive risk behaviour can be tricky but it is likely to have a more positive impact on culture in the long term compared to punitive measures,” Elliott added.

Culture beyond pay

The report found that many financial services companies had already or were making changes to their EVP beyond pay to better attract and retain talent.

Learning and development (47%) and remote working (43%) programmes were the most common ones cited, with other popular changes including career frameworks (37%), flexible working (37%) and non-monetary recognition programmes (34%).

These changes highlight the need to draw key talent with more than just pay, particularly after the last financial crash, and reflect a Chartered Institute of Personnel and Development survey that found staff increasingly felt under-employed and less likely to fulfil their career goals at their current employer.

Banks, in particular, who have since been struggling to attract and retain the best new talent, are realising that these so-called millennials are not just in it for the money,” said Mercer UK head of talent Mark Quinn.

“They look for a sense of pride and purpose in their work, as well as flexibility and career support. To attract them, companies need to develop a strong and genuine purpose-led employee value proposition,” he added.

Editor’s letter: What happens when leadership and culture fail?