How much and by when? How to tackle retirement uncertainty

- 8 Min Read

Like it or not, retirement means something very different in today’s world of work. How can HR leaders move employees from retirement uncertainty to retirement adequacy? Sophia Singleton, Partner & Head of DC Consulting, Aon, investigates.

- Author: Sophia Singleton

- Date published: Oct 10, 2019

- Categories

Ask most employees how they expect to support themselves financially when they retire, and they will say ‘my pension’. But dig a little deeper, and many are unsure how much income their pension will provide for them, at what age they will be able to afford to stop working or what their standard of living will look like after work.

With 27% of the UK population projected to be over 65 by 2037, we are all likely to have to work for longer, and businesses will increasingly need older people to meet their workforce requirements. According to the Office for National Statistics, the proportion of economically active 65 to 69 year-olds is expected to be 50% by 2067, compared to just 10% in 1992.

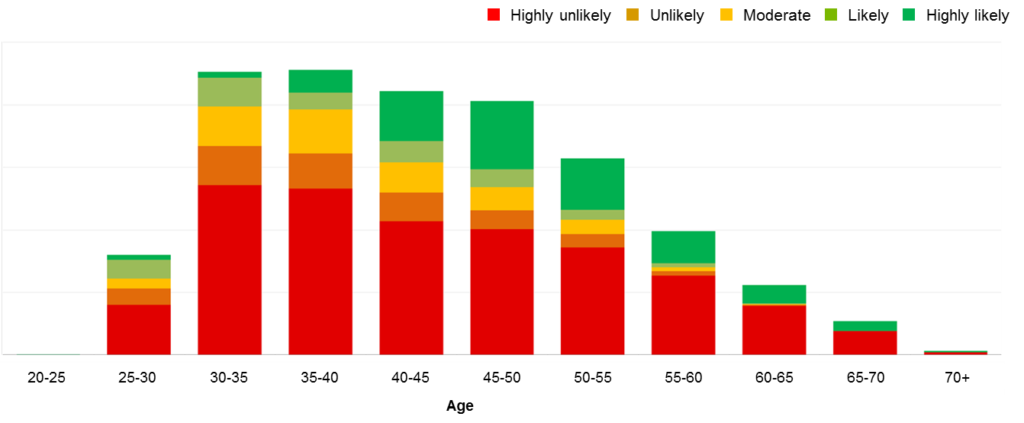

The traditional ‘cliff edge’ of retirement where an employee works full-time and retires on a given day is becoming less common. Aon’s 2019 Global DC and Financial Wellbeing Survey found that only one in three employees expects to go straight from full-time work to full-time retirement. People’s expected retirement ages are also getting later, the same survey found that less than half of people now expect to stop working by the age of 67.

The employer and employee view

This disconnect between traditional expectations of retirement and the reality over the last 10 years of a 109% increase in the number of men and a 115% increase in the number of women over 70 working part-time, has implications both for employees and employers. https://www.theguardian.com/money/2019/may/27/number-of-over-70s-still-in-work-more-than-doubles-in-a-decade

Employees are now able to access their pension savings from the age of 55, with no default retirement age. That means, in theory, that everyone has complete control over how and when they leave work.

That flexibility is often tempered by employees’ financial situation and their confidence about whether they have sufficient savings for an adequate retirement. Aon’s research found that less than half of UK employees have a retirement savings goal, and that around 60% worry about not having enough to be able to afford to retire.

Fewer people are now retiring with defined benefit pensions, so the importance of helping employees understand how much money they need to save into a defined contribution pension to fund an adequate, sustainable standard of living in retirement has become more important than ever.

A workforce with no certainty over its retirement plans is a concern for employers as well. From a business perspective, there are several issues to consider:

- Employees who do not know when, or if, they will be able to afford to retire make future workforce planning difficult, and affect job design, with increasing demand for part-time and flexible roles. This situation can also drive up the cost of some insured benefits for older workers and may mean an increase in certain types of sickness absence – especially musculoskeletal issues which account for 50% more sickness absence in workers aged over 50, than with 25 to 34 year-olds.

- Shifts in the UK’s labour supply and changes to State Pension Age mean that all employees are likely to have to work for longer, unless they take control of their own retirement finances.

- Conversely, senior staff who have reached the pensions Lifetime Allowance (LTA) or who are affected by the limitations of the Annual Allowance may opt to take early retirement. In some sectors, that is already leading to a loss of specialist skills and experience which is impacting businesses.

Data analysis tools, like Aon’s DC analytics, can help to recognise these different groups within your workforce, by recognising whether the current path is likely to lead to an adequate pension income.

Why employees need to engage with pension savings

While there are advantages to working for longer, these are quickly negated if an employee’s main reason for staying at work is their inability to retire.

Employees need to be able to make realistic, well-informed decisions about when and how they leave the workforce. That means helping them to create a meaningful link between what they are saving into their pension every month and what their expectations are for retirement. Armed with that knowledge, everyone will be in a better position to decide how to shape, or re-shape, their retirement plans.

Helping employees plan for retirement is a lifelong project that forms part of wider financial wellbeing. Aon found that 35% of UK employees find dealing with money stressful, with workers early in their career particularly affected. Enabling staff to create good financial habits right from the start of their working lives will encourage regular pension saving, as well as helping employees manage their day-to-day finances.

When employees reach their middle working years, a ‘mid-life MOT’ can help them understand whether they have set realistic aspirations for their retirement and have a clear plan to achieve them. This should focus not just on pensions but also on other sources of income in retirement, such as wider savings and the state pension.

As they approach the age of 55, employees will need advice and guidance on the different ways that they can use their pension pot, including drawdown, buying an annuity or taking cash. The decisions individuals make at this stage will affect their financial wellbeing for the rest of their lives and are often irreversible. Research from the Centre for Ageing Better showed that over half of those who have retired in the last five years had not sought any help or advice to prepare for retirement.

However, employee engagement is only part of the story and needs to be underpinned by a good quality DC pension scheme. A well-managed arrangement with appropriate default options is at the heart of supporting good outcomes for everyone, delivering sustainable income for life, letting employees select the way that they want to use their money at retirement, letting them decide when they want to retire, and – crucially – letting individuals adjust their plans over time.

How can employers help?

There are many ways that employers can help employees move from retirement uncertainty to retirement adequacy:

- Use a wide range of communication methods and techniques. Every workforce is made up of employees with different financial circumstances and attitudes to money that will affect their ability and willingness to save. Employees will need a mix of different engagement methods and communication approaches to help them overcome the typical apathy about retirement planning and engage with their pension savings.

- Help with ‘nudges’. Techniques such as ‘opting down’ can encourage higher rates of pension savings. This approach increases everyone’s contribution rate, but then allows employees to reduce their contributions if they wish. Aon has found that the majority of employees base their contributions on the rate their employer sets, so this can be an effective way of helping everyone save more for retirement. In our experience, more than 70% of participants will continue to save at the higher rate.

- Turn information into action. Reviews such as mid-life MOTs are important – but helping employees act on the findings is essential. For example, an employee might need to delay their retirement, or contribute more into their pension in order to make sure they have sufficient funds to meet their expectations of living standards. It needs to be simple for them to make changes with as little difficulty as possible.

- Take a wide view on savings. As more employees become affected by the LTA, diversified approaches to retirement savings that include Individual Savings Accounts (ISAs) and other products as well as pensions, could give high earners more options and help retain them in the workplace.

- Use pensions data to plan. Businesses can understand more about their workforce’s potential retirement patterns by analysing data from their pension scheme. That can help define future workforce needs as well as identifying groups of employees who might need more support as they approach retirement.

- Make sure DC schemes are fit for purpose. For example, how well does the scheme or provider help employees engage with their savings and forge the all-important link between contributions and adequate income in retirement? Does it offer default investment pathways that support an employee’s likely goals without the employee needing to take advice? Are there tools such as digital dashboards and links to financial education to help employees plan?

Done well, the company pension can support employees with the transition into a comfortable retirement, as well as helping the business with workforce wellbeing and long-term succession planning.

Click here to request a copy of our DC pension and financial wellbeing research, or to talk to one of our specialists.