Why is it difficult to engage younger employees with pensions?

- 6 Min Read

Steve Watson, Head of Proposition, Smarterly, examines why it’s so difficult to get younger employees on board with pensions, and how you can make it happen.

- Author: Steve Watson

- Date published: Jan 21, 2020

- Categories

For most employers, pensions contributions represent the second biggest people related cost; second only to direct payroll costs. But for a lot of employees – especially younger employees – they’re not the most valued benefit and so engagement rates are low.

In our recent research[1], we found that over 30% of younger employees (18-35 years old) engage with their pensions twice a year at most. Over 11% stated that they never engage with their scheme at all.

From a business perspective, low engagement rates equal low return on investment.

Two out of five businesses recognise that their staff aren’t engaged with pensions and perhaps more alarmingly 51% believe that their pension scheme has no impact on their ability to recruit or retain employees[2].

If you were getting these results for any other employee benefit with a similar price tag would you continue to offer it?

It’s a continual challenge for employers, who often focus on what they can do differently to communicate the pensions offering in an attempt to improve employee engagement. Afterall it surely can’t be the pension scheme itself which is the issue? It must be the way it’s communicated to employees. So, lots of money and effort is spent on member booklets, presentations, leaflets and one to one advice or guidance sessions.

But is communication really the main issue?

At least for younger employees, I would say no.

18-35 year olds

Retirement is a long way off for these individuals and between now and then, they will have a lot of expensive life events to deal with; marriage, first home, kids etc. All of which are, of course, going to seem a lot more important than an event that’s probably 30 plus years away.

The reality for a lot of younger employees is that getting on the housing ladder is more important than planning for retirement. This isn’t to say pensions aren’t important, they just aren’t the priority for people of this age.

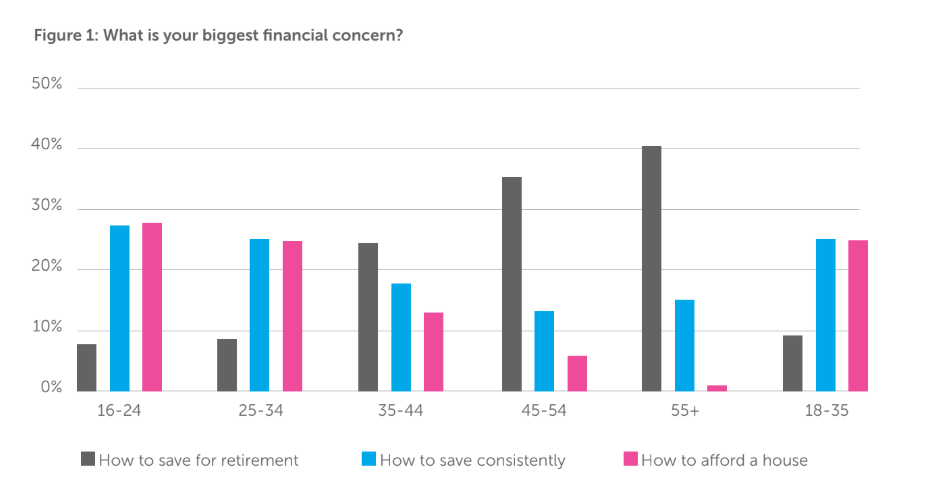

As demonstrated by our research (see Figure 1) it’s only as we get closer to retirement, that we really start to worry about retirement and therefore this is when pensions become more important.

Improved communications might go some way to improving pension engagement rates amongst younger employees, but my guess is that in general they’ll remain low.

Understand the needs of younger employees

If a revamped communication strategy won’t drastically change the situation, what will? How about providing something that this group of employees actually need?

And by this I don’t mean what we think they need.

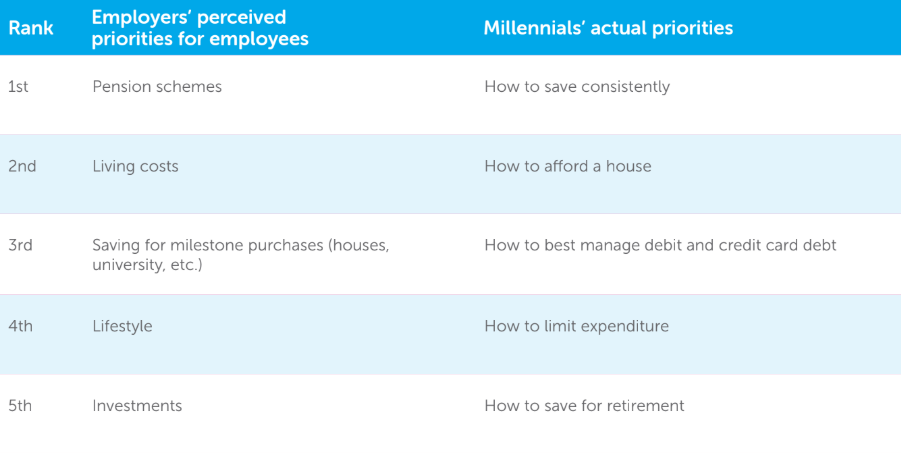

In our research, we asked employers what they thought were the financial priorities of their employees and compared this to what employees said were their financial priorities. For the younger employee groups, the results clearly demonstrate the misalignment (see figure 2).

The priority ranking for millennials reflects Maslow’s hierarchy of needs[3]; the basic needs must be achieved first. With the best will in the world, if an employee is battling with spiralling debt or looking to get together a hefty deposit for their first home, no matter how good your pension communications are, saving for retirement is going to be the last thing on their minds.

Unless the first four issues are dealt with first, engagement with pensions will remain low.

Many employers have introduced some form of financial education into the workplace often as part of a wider financial wellbeing programme. There’s no doubt that this type of initiative can make a big difference to limiting expenditure and managing debt.

But it still doesn’t provide a solution for saving for a deposit for a first home.

The game changer

When people talk about workplace savings, they’re in the main still referring to pensions. But this is quickly changing as employers recognise that increased employee engagement with benefits including pensions is about addressing specific employee needs.

In reality, ‘workplace savings’ refers to pensions in addition to other savings vehicles such as workplace Individual Savings Schemes (ISAs). The idea is that because pensions can only provide for one type of financial need, other savings initiatives are introduced to meet other financial needs.

NEST the pension scheme set up by Government to specifically deal with auto enrolment is currently conducting a trial of its sidecar concept. In a nutshell, payroll contributions that would normally go into a pension scheme only, are split between the pension scheme and a separate savings account. The savings account has a predetermined limit and once this has been reached, payroll contributions will continue to be paid into the pension scheme only.

This means that the employee is saving for retirement but also has an emergency savings account they can take money out of before retirement should they need to.

Again, this doesn’t address first home purchase, but the solution for that is simple. Introduce a workplace Lifetime ISA (LISA).

Since November 2019, Help to Buy ISAs are no longer available to new savers. But the LISA is still here and with a 25% Government bonus (of up to £1k a year) it’s a perfect vehicle for employees to save for a deposit.

Some employers are allowing their employees to redirect some of their pension contributions (over and above the auto enrolment minimums) into this type of savings vehicle. For employees that don’t qualify for a LISA (you have to be between the ages of 18 and 39), there are other types of ISAs available, and although they don’t qualify for the 25% Government bonus (see Figure 3), they allow people to save a certain amount tax-free.

You now have an employee who is still saving for their retirement but also being helped to save for their more immediate needs i.e. first home purchase.

Communicating a workplace savings scheme that addresses important financial needs is more likely to increase engagement rates than a pension scheme on its own!

Find out more about workplace savings.

[1] Realigning the workplace savings offering to meet the needs of millennials – Smarterly Research 2019

[2] Research carried out by the CBI and Aegon – 2018

[3] A theory of human motivation, Psychological Review, Maslow, 1943