May Review: Marketing Technology Trends & Food for Thought

- 4 Min Read

Since the beginning of May we have been running a pulse survey across ClickZ and Search Engine Watch tracking 5 basic data points related to marketing budgets and marketing technology spend/demand.

- Author: HRD Connect

- Date published: May 27, 2020

- Categories

Since the beginning of May we have been running a pulse survey across ClickZ and Search Engine Watch tracking 5 basic data points related to marketing budgets and marketing technology spend/demand.

We have shared some of this data privately with some of you, but here is the aggregated view.

We’ve also added some interesting charts at the end of this based on some background research we have been conducting into the recovery and a view of the ‘new normal’.

I hope this is useful and please reach out if you would like to discuss, partner, collaborate (open to all ideas!) or I can help with anything.

Latest research & analysis

As mentioned, we have been busy over the last few days looking through the responses of our pulse survey tracking 5 core sentiment metrics covering the demand for marketing technology and the change in marketing budgets.

The charts below show the 7 day moving point average.

The change in marketing budgets

First up we look at how marketing budgets have changed over the last month.

As you can see we are still seeing a significant percentage decreasing their budgets (blue), but, we have seen the number increasing their budgets improve slightly towards the end of last week and then flatten again this week.

Spending on marketing technology

Next up we look at if marketers are planning to spend more or less on marketing technology.

You can see that we have a slightly more positive view here with the orange section, representing increasing spend on martech, growing significantly over the last week.

Mid-May is where we currently see the biggest spike in the number of people looking to decrease their spend.

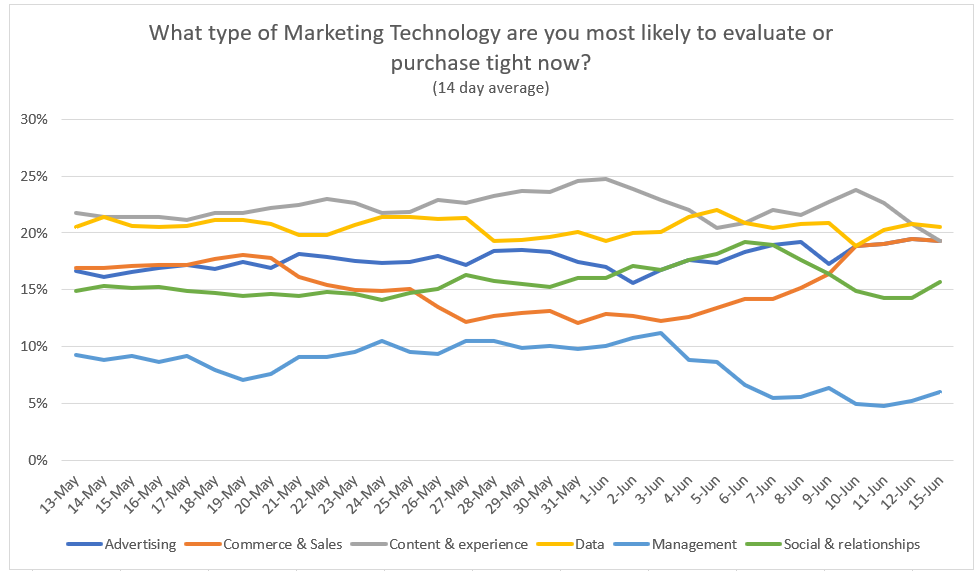

Which technologies are marketers looking to evaluate or purchase right now

This chart asked marketers to rank in order which technologies they were looking to evaluate or purchase right now. We then took the top 3 choices and combined them into a 7 point moving average as shown below.

As you can see, Content & Experience tech (grey), along with Data (yellow) were consistently ranked top.

Interestingly, Commerce & Sales (orange) has seen the biggest decline since mid-May, with Management tech (red) making a come back.

This seems to align with what we are are hearing in the market, with brands focusing more on communicating sensitively to customers (Content & Experience) and less on applying pressure on cart abandonment etc. (Commerce & Sales).

The increase in Management tech, could also be a factor of the reality of moving to a longer-term remote set-up that will require tighter governance and processes to manage.

Diving deeper into the specific data-focused technologies, we see Analytics, Performance and Attribution out front as well as Data Science and Customer Intelligence tech.

Again, as companies focus on brand and cautious outreach, having a clear view of what’s going on (analytics), understanding what’s working (attribution) and reacting effectively to customer interactions (customer intelligence) seems like a sensible place to invest if you can.

Food for thought

Finally, we have been looking carefully at the impact of COVID-19 and more importantly what the ‘new normal’/recovery might look like.

Here are some charts that we thought were interesting and worth sharing.

This chart (if you haven’t seen it already) showing that the US economy shrank (GDP) by an annualized 4.8% in the first quarter of 2020 (estimated) ending the longest period of expansion in the country’s history was quite alarming.

Adobe’s share price is up since the beginning of the year:

This one from the Financial Times showing the range of recovery scenarios from top economist made us pause for thought (and put a smile on our faces) and shows that no-one knows what is going to happen.

This one looking at who has the most cash (as of Nov 19) was interesting and shows how dominant the tech giants are in these times of tight liquidity.

And finally, the funding in 2019 for Marketing Technology companies hit another record in 2019.

It will be interesting to see when the pressures/commitments made to secure funding will start to cause a flow of marketing dollars back into the market – is this sign that we will see a quick recovery in the martech world?

I hope this was useful and please reach if you are interested in partnering/collaborating on anything (open to all ideas!), or if there is anything I can do for you – just shout. Email is [email protected].

Sam