Why the financial wellbeing of your staff is more important than ever

- 3 Min Read

The impact of poor financial wellbeing on your employees during a time of great uncertainty can be devastating to your most dedicated workers and the success of your business. How can HR disrupt the negative financial cycle?

- Author: Emily Downer

- Date published: Jun 25, 2020

- Categories

The outbreak has turned the working world upside down across the globe and things may never return to what we might call ‘normal’. What this presents for organizations is a new challenge when trying to engage with their staff.

Without traditional forms of communication and engagement, employers need to find new ways to build and keep that connection. One of the key ways in which employers can seek to do this is by improving the financial resilience of their staff; something that’s now more important than ever.

Financial resilience is more important than ever

More than half of UK consumers started 2020 carrying debt. With UK households predicted to see a £45 billion fall in cash available for essential spending due to the outbreak, it’s clear that the extended period of economic downturn is set to have a significant effect on the financial resilience of staff.

Financial worries are having a real impact on your employees when they’re at work, even though they may not be ‘at work’ in the traditional sense. A PWC survey found that 48% of workers say that their financial worries are a distraction at work and 54% say that financial worries are the biggest stress factor in their lives.

What the new working world demands, and therefore how HR strategies should be framed, is a whole new approach to how employers support their staff when it comes to their financial resilience. A powerful way in which employers can do this is by looking at the way staff get paid. It’s something that hasn’t changed for decades; the majority of workers across the world are paid monthly, leaving many financially exposed and unable to plan for the future.

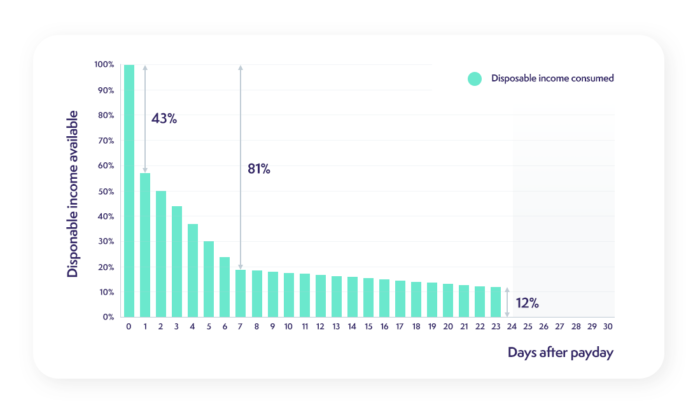

The feast and famine effect of the monthly pay cycle means, on average, that 43% of disposable income is spent in the first 24 hours after payday, exposing 3.1 million people in the UK to payday lenders every year.

Disrupting the negative financial cycle

Employers are in the best position to disrupt the negative financial cycle and have a real positive impact on, not only their employees’ lives, but also on their ability to engage and retain the best talent; something that is going to be crucial as we move through recovery. It’s an area that’s ripe for innovation and could return real value for employers in terms of a loyalty and engagement dividend.

Running payroll more frequently isn’t an option for many, so employers looking to disrupt this cycle need to look at technology solutions that sit between them and their staff to provide more flexibility around pay, and ultimately, financial resilience.

As we start to move into the new working world, there will be a whole new set of demands for employers when it comes to reward and benefits strategies. Employers looking to effectively answer these demands and future-proof their workforce need to start making changes now that are going to have a genuine impact on the lives of their staff. There is no better way of doing this than by building financial resilience for workers globally.