How can HR leaders bridge the diverging expectations of CEOs and investors?

- 6 Min Read

CEOs and investors have widely different views over key issues affecting the security, stability and future performance of major companies – and HR leaders can help address these variations.

- Author: Owain Thomas

- Date published: May 4, 2016

- Categories

CEOs and investors have widely different views over key issues affecting the security, stability and future performance of major companies – and HR leaders can help address these variations.

Performance incentives, the availability of key skills, value creation and corporate responsibility were flagged as areas of significant difference.

But according to the PwC Redefining business success in a changing world: Global survey of investor

and CEO views study, there were also important topics that CEOs and investors agreed on and will need HR to deliver on.

The consultant surveyed 438 global investment professionals and benchmarked their views against those 1,400 chief executives.

Where they disagreed:

Availability of key skills

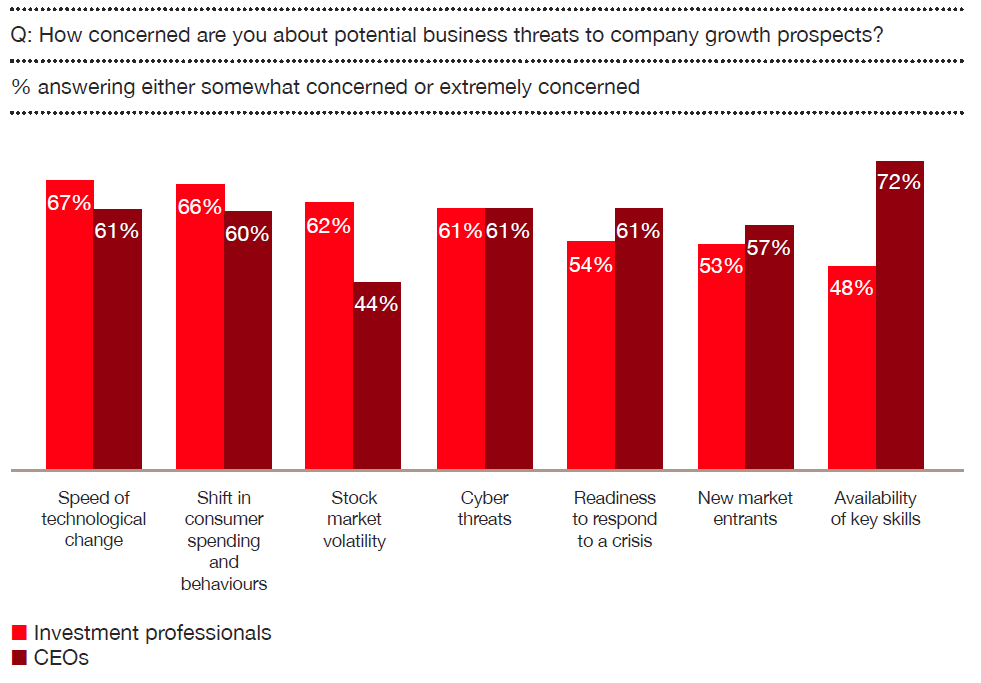

CEOs and investors are largely aligned on the biggest threats to corporate growth; however the biggest disparity here was in the availability of key skills. (see chart below.)

While CEOs saw it as their biggest concern, investors rated it as their smallest concern; a focus which was consistent across all locations, the report noted.

CEOs were also significantly more likely than investment professionals to see a lack of the right capabilities as a barrier to change when responding to wider stakeholder expectations, although the percentages for both groups were relatively small.

In contrast, investment professionals may have less visibility over the internal skills threat than CEOs. As a result, investment professionals may think companies have this issue more under control than they actually do.

PwC suggested that companies might want to disclose the risks they faced around the availability of skills more comprehensively including the scale of the corporate challenge in developing and maintaining an adequate talent pipeline.

HR leaders could play a key role here in ensuring that they can address the fears raised by providing a secure and flexible talent pipeline for the business. And by reporting it well they can help investors understand how important this is to the organisation.

The report added that some companies may be highlighting the issue, perhaps in relation to their activity in sponsoring university courses or training programmes.

(all graphs from PwC)

(all graphs from PwC)

Executive remuneration

The investment community was significantly more likely than CEOs to consider misaligned performance incentives as a barrier to change.

The mismatch between the two camps reflected the strength of feeling in this area: almost half (49%) of investors surveyed flagged this as a major concern compared to only 17% of chief executives.

This was highlighted last month when some 59% of shareholders rejected BP chief executive Bob Dudley’s £14m pay package.

PwC noted that it was another potential area where reporting could be improved, adding that companies had more visibility internally into how management was remunerated than investment professionals received from the outside.

The consultant also asked what changes to remuneration policies needed to be made to ensure that executive incentives were aligned with shareholder interests?

Workforce diversity and inclusivity

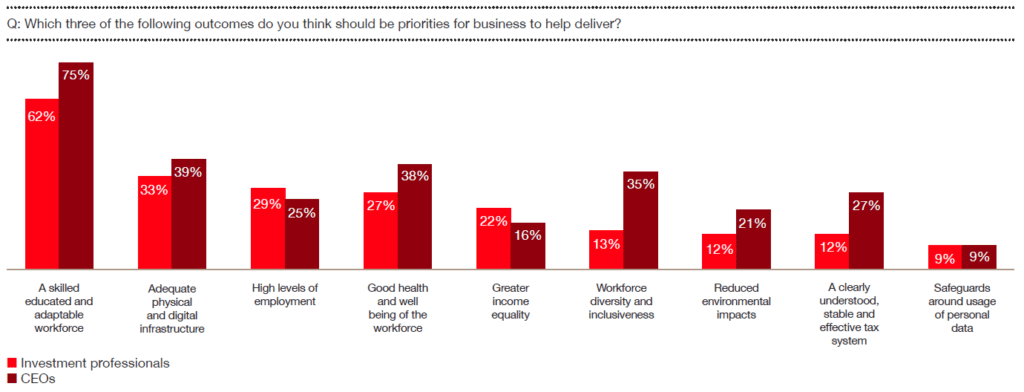

Other differences came out in the priority outcomes of the business, where CEOs believed that a diverse and inclusive workforce was much more important than investors did. And a similar, albeit smaller gap, was seen in the need to maintain the health and wellbeing of the workforce. (see graph below.)

By illustrating the importance to business performance of these outcomes, HR leaders can relay to investors why it is important to maintain them as a priority.

Business purpose

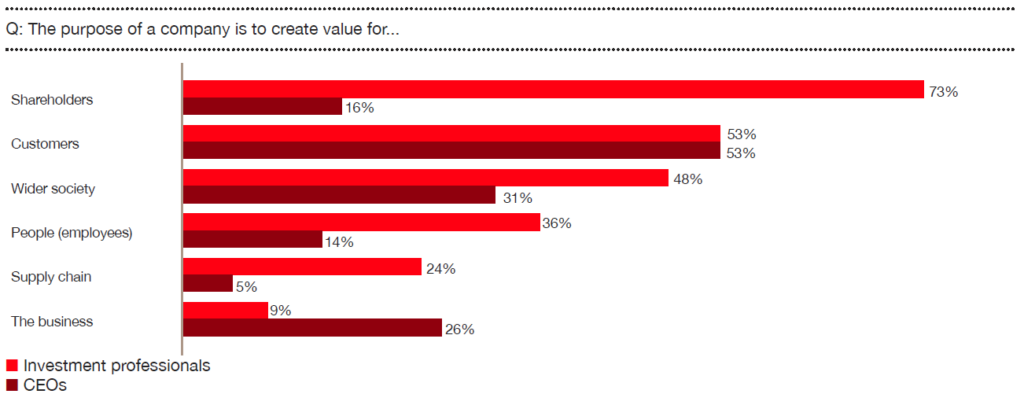

However, the biggest difference between CEOs and investors came in the overall purpose of the business. (see graph below.)

Unsurprisingly investors believed the primary aim was to create value for shareholders, although this came as a rather distant priority for CEOs.

Both sets of respondents put the customer at the heart of their value basis as well, but investors were more likely to include wider society and employees as deserving value from the business.

These desires link strongly to corporate social responsibility agendas and by creating strong identities in this area, HR teams can boost the wider value generated by the business and its public image.

Where they agreed:

Demographic shifts

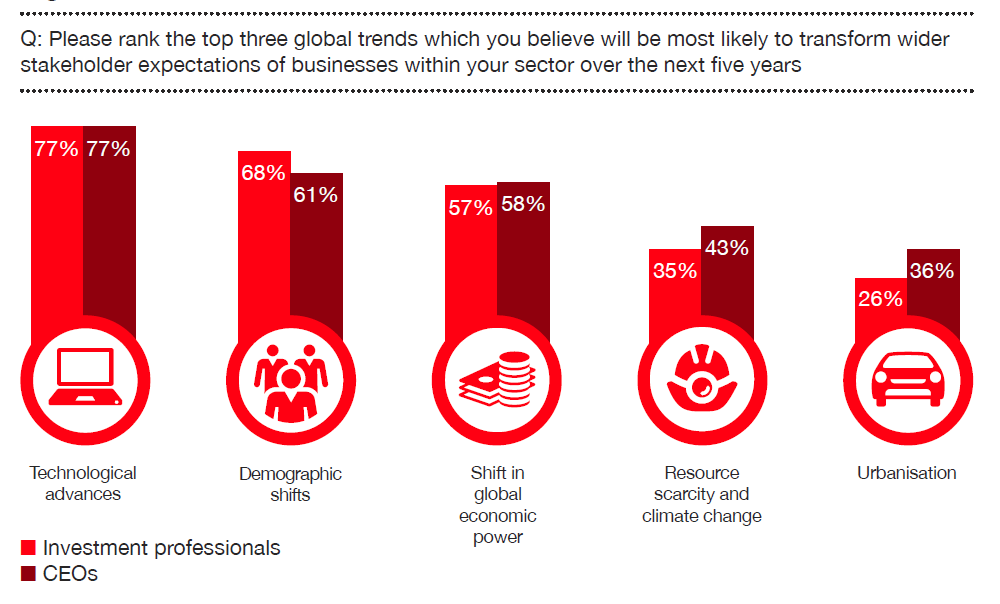

Perhaps unsurprisingly, both parties noted that new technologies and demographic shifts were the major drivers of change within businesses across the world over the next five years. (see graph below.)

HR leaders will see a significant effect from both these sources as they also interact with each other and its encouraging that major parties involved in running large organsations are agreed on the importance of these factors.

Skilled, educated and adaptable workforce

CEOs and investors also agreed on the importance of a skilled, educated and adaptable workforce, which would be ready to work in the conditions brought about by the technological and demographic changes. (see second graph above.)

Given this agreement, it is perhaps surprising that the disparity exists on the importance of other issues such as the availability of key skills and the need to encourage an inclusive and healthy workforce.

Reality gaps

Overall, PwC suggested there were three gaps which needed to be addressed to ensure senior management and investors were on the same page:

A reporting gap – companies and investors are finding it difficult to agree what information is needed in order to form accurate opinions;

An understanding gap – investors may sometimes have the same facts as CEOs, but draw different conclusions;

A perception gap – investors may have the facts, but do not place the same importance on them.

The report suggested that CEOs might need to focus on enhancing their company reporting and investment professionals might need to be more vocal in asking for the information they required, in the form they valued.

“Building effective communication is a two-sided activity,” it said.

“Investment professionals have a vital role to play in questioning and challenging the information they are given. CEOs need to take up the challenge by looking hard at what their companies say and how they say it.”

PwC investor engagement director Hilary Eastman added that she was struck by the differences of opinion the research has revealed.

“Investment professionals, for example, appear far less concerned about skills shortages and the threat these pose to business growth,” she said.

“Investor and analyst responses suggest a desire for businesses to operate in more socially responsible ways, rather than putting financial profit generation above all else. CEOs may also be surprised to see how much attention some investment professionals are paying to wider issues related to the environment and society.

“However, I’m encouraged to see that CEOs and investment professionals share similar opinions on a number of issues. It’s also interesting that both groups see technological advances and demographic shifts as the top two global trends most likely to transform wider stakeholder expectations of business over the next five years,” Eastman concluded.